April 2023

Monthly Market Update

Macro Update

- A third regional bank – First Republic – failed in April as higher interest rates and diminished deposits continued to test the banking industry. Despite the additional bank failure, markets remained relatively calm in the month as the industry overall is still viewed to have stabilized.

- The US House of Representatives passed legislation to raise the debt ceiling and cut spending. The measure has little chance in the Senate, but is the first step towards negotiations with the White House and sets up a contentious battle given the proposed spending cuts.

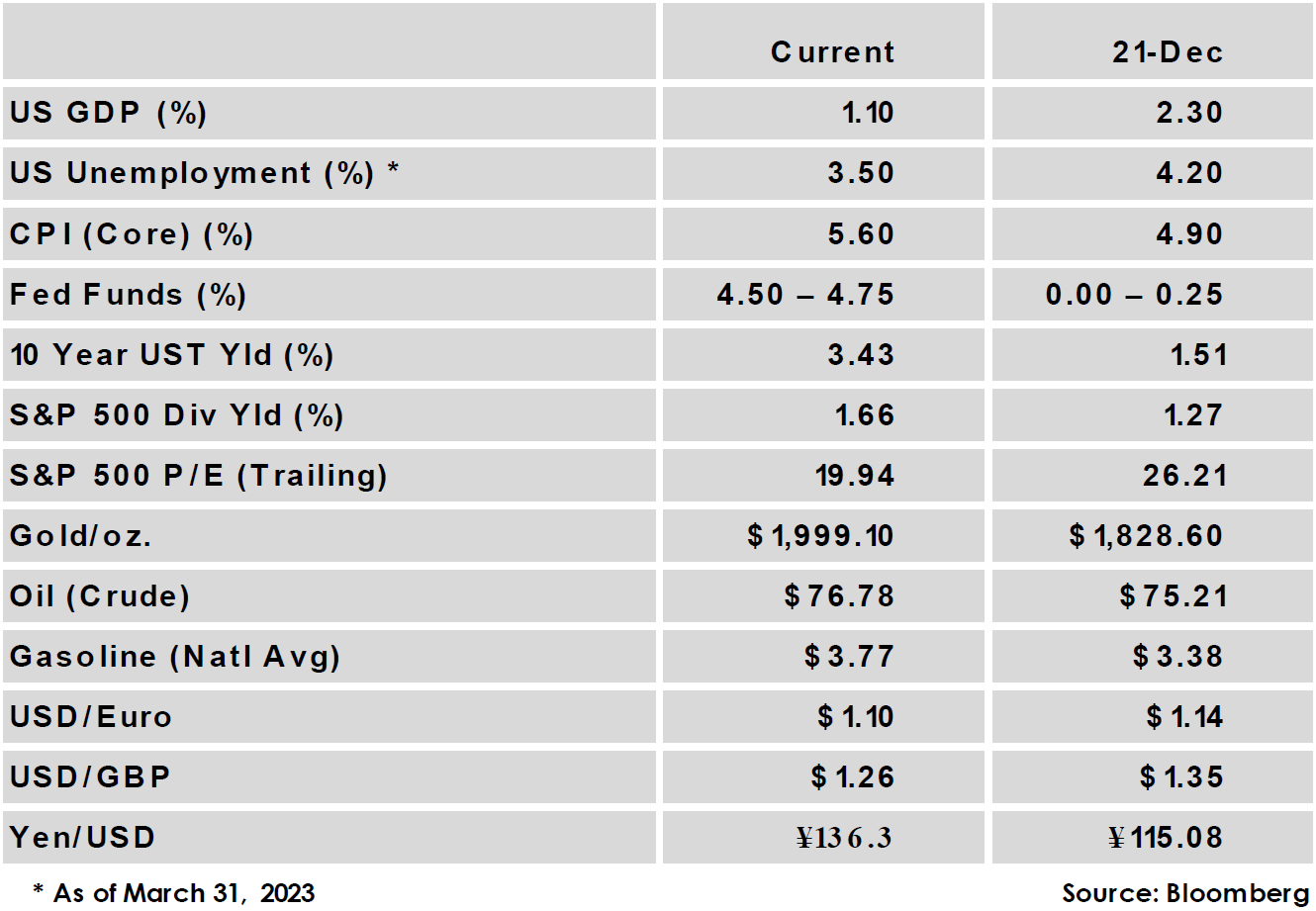

- US real GDP grew at a 1.1% annualized pace in the first quarter, below expectations and a slowdown from the 2.6% rate in the fourth quarter.

- US CPI was below expectations, declining from 6.0% to a 5.0% year-over-year increase. The US labor market remained robust as payrolls again surprised to the upside and the unemployment rate fell back to 3.5%.

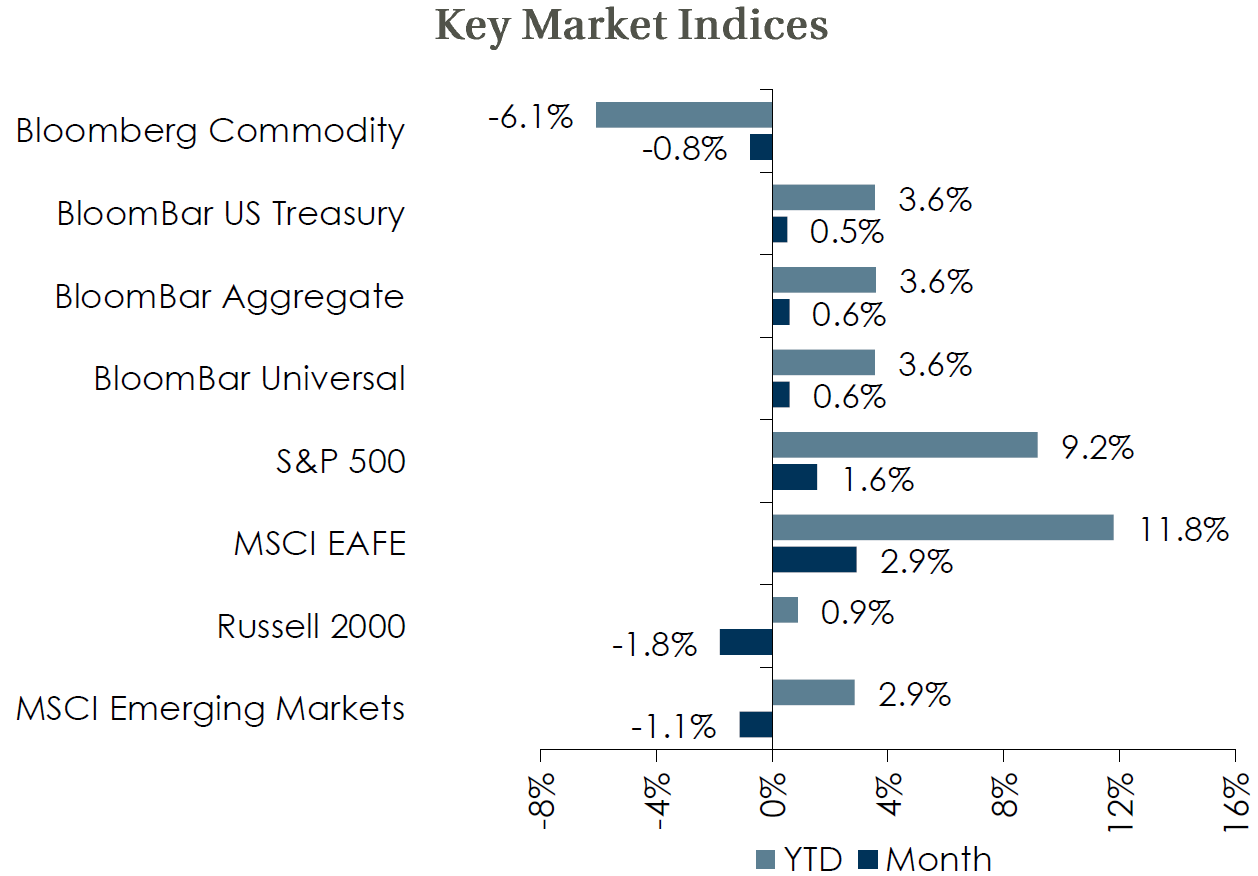

Global Equity

- Equity markets were mixed in the month with lower volatility. US large caps and Non-US developed were both moderately higher while US small caps and emerging markets declined.

- Earnings have been supportive of market sentiment. Slightly over half of S&P 500 companies have reported Q1 earnings, and nearly 80% have reported a positive EPS surprise.

- Valuations on forward earnings were little changed. Forward earnings projections have been under pressure in recent months across indices, and Non-US developed currently exhibits the strongest recent upward trend.

Global Fixed Income

- Rates across most of the US Treasury curve were little changed in the month with the 10-year Treasury yield declining 4 bps to 3.43%.

- Interest rate volatility fell from March levels but remains elevated. Credit spreads declined slightly in the month with investment grade spreads 2 bps lower and high yield 3 bps lower.

- The FOMC is largely expected to deliver one more 25 bps hike at their meeting in early May, with the potential for a pause after that.

Global Real Estate

- Core real estate returns delivered a second consecutive quarter of negative returns in the first quarter of 2023.

- Real estate returns could continue to be challenged as higher interest rates put upward pressure on cap rates, which currently sit near historic lows.

- Banking industry stress could put further pressure on the commercial real estate market by constraining lending and raising borrowing costs.

|

|

Disclosures and Legal Notice | © 2023 Asset Consulting Group. All Rights Reserved.